With the sudden halt of the Apple Pay Later feature, Apple users are left pondering the implications of this unexpected move. As one of Apple’s innovative payment solutions, the withdrawal raises questions about the company’s future focus and strategy. This change not only impacts current users but also sparks broader discussions on the evolving landscape of digital payment services. What prompted this decision, and what could it signify for Apple’s position in the market? Stay tuned to unravel the complexities surrounding Apple’s latest maneuver.

Reasons for Apple’s Decision

Due to changes in economic conditions, Apple decided to discontinue the Apple Pay Later feature, citing higher interest rates as a key factor in their reasoning.

The escalating interest rates impacted the feasibility of offering pay later loans through Apple Pay, making it financially untenable for the company. With credit becoming more expensive, Apple had to reassess the sustainability of providing this service to its users.

The decision to halt Apple Pay Later underscores the challenges posed by the rising cost of credit in today’s economic landscape. By withdrawing this feature, Apple aims to navigate the evolving financial environment while safeguarding its users from potential credit risks associated with pay later options.

This strategic move reflects Apple’s proactive stance in responding to economic shifts and underscores the importance of financial prudence in the domain of digital payment services.

Impact on Apple Pay Users

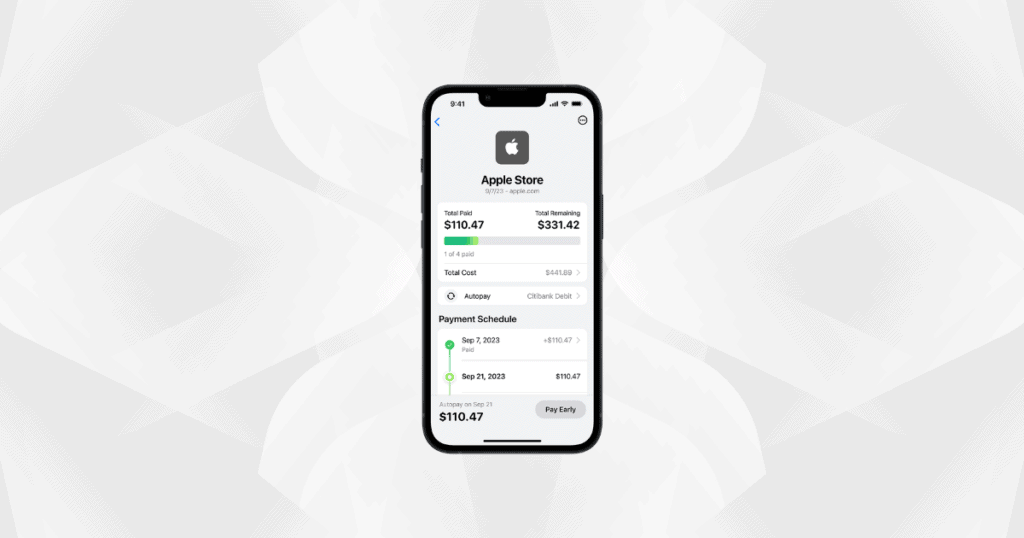

The discontinuation of the Apple Pay Later feature by Apple has implications for how users manage their payments and future purchases. Existing Apple Pay Later users can still manage and pay their open loans through the Wallet app.

However, those accustomed to utilizing Apple Pay Later for interest-free financing may now need to explore alternative payment options to spread out their payments. The removal of Apple Pay Later could prompt users to reassess their approach to making Apple-related purchases, potentially impacting customer loyalty and satisfaction.

With the shift away from Apple Pay Later, users may also be compelled to contemplate other installment loan offerings that will soon be available through Apple Pay. This change signifies a significant adjustment for Apple Pay users, urging them to adapt to new payment methods and reconsider their financial strategies when making purchases through the platform.

Comparison With BNPL Services

In comparison to traditional BNPL services, Apple Pay Later offered a unique payment structure that allowed users to split purchases into four equal payments over six weeks with no fees or interest.

Payment Structure:

- Apple Pay Later: Four equal payments over six weeks with no fees or interest.

- Traditional BNPL services: Usually immediate first payment followed by installments every two weeks.

Application Process:

- Apple Pay Later: Applied directly in the Apple Wallet app for loan amounts of $50 to $1,000.

- Other BNPL services: Often require separate applications for approval.

Credit Checks:

- Apple Pay Later: Considers purchase cost, card funds, and payment history for approval.

- BNPL services: Typically conduct soft credit checks for eligibility.

Risk Awareness:

- BNPL services: Pose risks of overextension and accumulation of unnecessary debt.

- Apple’s decision to discontinue Apple Pay Later shows an acknowledgment of consumer protection concerns related to BNPL services.

Consumer Protection Concerns

Consumer protection concerns surrounding Apple Pay Later primarily revolve around the potential risks of overspending and accumulating high levels of debt among users. The allure of the pay later service may lead individuals to make impulse purchases beyond their means, resulting in financial strain. Financial experts warn against the dangers of overextending with BNPL features like Apple Pay Later, emphasizing the importance of responsible spending habits. The lack of strict regulations in the industry also raises red flags, prompting concerns about the potential exploitation of consumers’ financial vulnerabilities. The Consumer Financial Protection Bureau (CFPB) has highlighted the need for enhanced oversight in the BNPL sector to safeguard consumers from predatory practices and unsustainable debt levels.

| Consumer Protection Concerns | |

|---|---|

| Potential Overspending | Accumulation of High Debt |

| Caution from Financial Experts | Regulatory Concerns from CFPB |

| Importance of Responsible Spending | Need for Enhanced Oversight |

Future Plans From Apple

How will Apple’s expansion of installment loan features through Apple Pay impact users globally?

Apple’s decision to introduce new installment loan offerings to Apple Pay on a global scale signifies a shift towards enhancing the payment experience for users worldwide. The new installment options aim to provide increased flexibility and accessibility in managing payments through Apple’s platform.

Here are some key aspects of Apple’s future plans:

- Global Reach: Apple intends to extend its installment loan features beyond the U.S., making them available to users in multiple countries.

- Access to Loans: Users will be able to access loans from eligible credit or debit cards and lenders directly through Apple Pay.

- Replacement of Apple Pay Later: The unique split-payment functionality of Apple Pay Later will be replaced by these new installment loan options.

- Commitment to Evolution: By focusing on global installment loan offerings, Apple demonstrates its commitment to evolving its financial services and meeting the changing needs of consumers worldwide.

Through these initiatives, Apple aims to revolutionize the way users engage with payment solutions globally.

Industry Reaction and Analysis

Market analysts speculate on how Apple’s withdrawal of the Apple Pay Later feature will impact the buy now, pay later industry. With Apple discontinuing this service, competitors in the financial sector may see an opportunity to fill the gap left by Apple and expand their own flexible payment offerings. The removal of Apple Pay Later could also influence consumer behavior towards online installment payment services, potentially shifting market trends.

In light of Apple’s decision, questions arise about the company’s future financial strategies. By focusing on installment loans through Apple Pay globally, Apple might be signaling a broader shift towards more traditional loan services over the buy now, pay later model. This move could have lasting implications for consumer financing options within the tech industry, as Apple’s strategic choices often influence market standards.

As the industry adapts to Apple’s new direction, stakeholders will closely monitor how consumer preferences evolve in the domain of online loans and flexible payments.

Tips for Alternative Payment Options

Consider exploring various alternative payment options beyond Apple Pay Later to promote financial flexibility and encourage responsible spending habits. When looking for ways to pay for purchases without relying on Apple Pay Later, individuals can consider the following options:

- Traditional Credit Cards or Personal Loans:

These options provide flexibility in managing payments over time with potentially lower interest rates compared to some BNPL services. - Other BNPL Services:

Explore similar services from different providers to find terms that best suit your financial needs and preferences. - Installment Payment Plans from Retailers:

Some retailers offer installment plans for large purchases, allowing you to spread out payments without incurring interest. - Savings and Budgeting:

Saving up for purchases or using budgeting techniques can help avoid the need for financing altogether, promoting responsible spending habits.

For personalized guidance on the best payment options based on individual financial situations, consulting with a financial advisor can provide valuable insights and recommendations. By considering these alternative payment methods, individuals can make informed choices that align with their financial goals and priorities.

MacReview verdict

As Apple withdraws the Apple Pay Later feature due to economic challenges, users must adapt to new payment methods. This change serves as a reminder of the importance of financial responsibility in a dynamic market.

Like a ship adjusting its course in turbulent waters, consumers must navigate changing economic conditions and make informed decisions for their financial well-being.

Adapting to new payment options and strategies will help users sail smoothly through uncertain financial seas.